The Journey So Far

IFCI: The Journey over the 70 Years

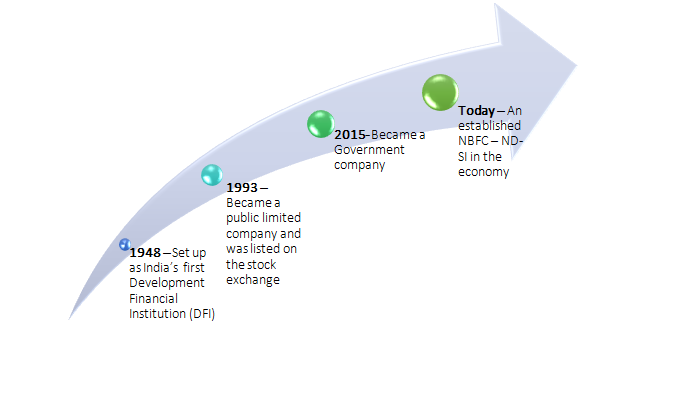

At the time of independence in 1947, the Indian Capital Markets were relatively less developed. The demand for capital was growing rapidly, however, there was a dearth of providers of capital. The commercial banks that existed were not equipped well enough to provide for long term capital needs in any significant manner. Against this backdrop and to bridge the demand supply gap for capital needs of the economy, the Government of India established The Industrial Finance Corporation of India (IFCI) on July 1, 1948 by enacting the IFC Act 1948.

IFCI was the first Development Financial Institution of India set up to propel economic growth through development of infrastructure and industry. Since then, IFCI has contributed significantly to the economy through its incessant support to projects in various spheres of growth & development viz. manufacturing, infrastructure, services and agriculture allied sectors. The Liberalisation of the Indian Economy in 1991 made significant changes in the Indian Capital Markets & Financial System. To aid raising of funds directly through capital markets, the constitution of IFCI was changed from a statutory corporation to a Company under the Indian Companies Act, 1956. Subsequently, the name of the company was changed to ‘IFCI Limited’ with effect from October 1999.

Since its inception, IFCI has witnessed and sustained all business economic cycles. IFCI has been able to maintain the financial sustainability with the consistent support and cooperation of all its stakeholders and particularly the Government of India. In addition to its core competence in long term lending to industrial and infrastructure sectors, IFCI has also developed competence in providing advisory services and has been a nodal agency for providing advisory services to various Govt. of India schemes such as Sugar Development Fund, M-SIPS, Production Linked Incentive (PLI) Scheme and Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS). Further, IFCI also enhanced its organizational value through optimising value of core and non-core assets & investments. Over the years, IFCI has played a pivotal role in establishment of various entities (including some of its subsidiaries & associates) that are respected in their fields today, namely Stock Holding Corporation of India Ltd (SHCIL), National Stock Exchange Ltd (NSE), LIC Housing Finance Ltd, Tourism Finance Corporation of India Ltd (TFCI), ICRA Ltd, among many others. With the changes in the markets over a period of time, a few of the subsidiaries were divested and currently IFCI Group has the following subsidiaries–

- Stock Holding Corporation of India Ltd,

- IFCI Venture Capital Fund Ltd,

- IFCI Factors Ltd,

- IFCI Infrastructure Development Ltd,

- IFCI Financial Services Ltd,

- MPCON

Besides above Subsidiaries, IFCI also setup up following institutions under its social sector initiatives : -

- Management Development Institute

- Institute of Leadership Development’

- Rashtriya Gramin Vikas Nidhi